Holiday E-commerce Sales Tip: Start Promotions Early in 2021

As the country slowly emerges from the COVID pandemic and the end of 2021 approaches, people are eager to celebrate the holidays with friends and family. Life is back to normal in many places, and that’s excellent news for online sellers! To capitalize on this moment, online retailers should start your holiday sales promotions early this year. Continue reading to learn why.

2021 E-commerce Sales Are Already Up 9% Over 2020

The numbers over recent months clearly indicate that shoppers are ready to buy online. According to Adobe’s Digital Economy index, consumers spent $541 billion online between January 2021 and August 2021. That’s 9% more than the same period last year and 58% more than 2019.

Online sales in November and December are expected to grow at least 7% from a year ago. And the National Retail Federation is expecting a record year for both online and brick and mortar sales in Q4 2021.

Problems in the Supply Chain

Q4 does have some challenges. Cargo ships sit offshore, waiting to be unloaded. There’s a shortage of truck drivers and warehouse workers. Railroad terminals are backed up with goods waiting for transport. Shipping carriers are preparing to deal with a record number of e-commerce packages. Seemingly every link in the supply chain is experiencing its own problems.

Because of continuing supply chain problems, shoppers were already being advised in late summer to buy early. Both the shortage of goods and the extended time required for shipping and delivery mean that last-minute shoppers may be left without much to give at holiday time.

The Answer – Run Your Holiday Sales Promotions Early

Retailers, both online and brick and mortar, typically have their biggest sales promotions of the year during Thanksgiving weekend for Black Friday, Small Business Saturday and Green Monday to kick start their holiday sales. But 2021 is different – e-commerce sellers MUST start encouraging buyers to purchase early this year. And there is no better way to get sales moving than by running those Black Friday deals early this year. Getting customers to buy early will get product into their hands quickly while eliminating last minute inventory or delivery issues.

4 Easy Sales Promotional Ideas

Given the uniqueness of this year’s holiday season, how can you promote your products? Here are a few sales promotions that work well:

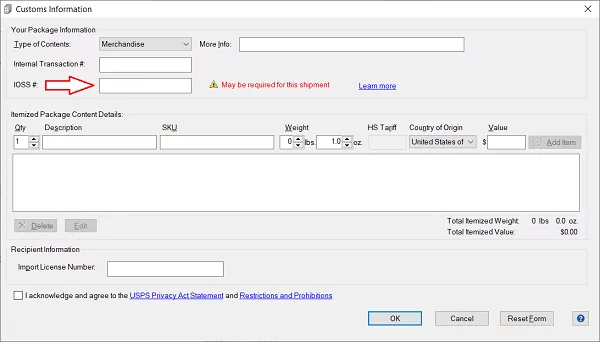

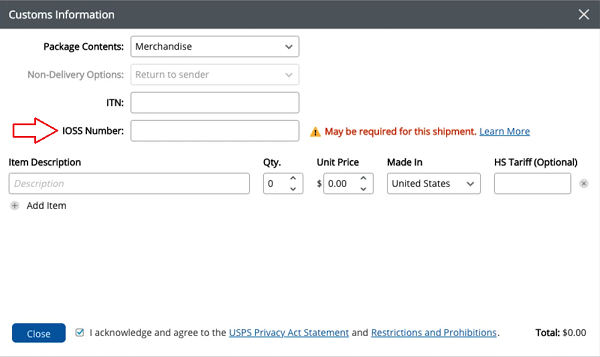

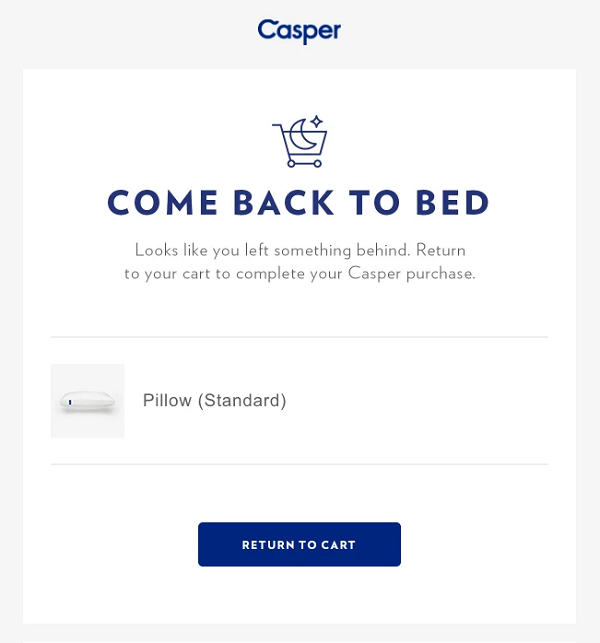

#1 Start an abandoned cart email campaign: An abandoned cart occurs when a potential buyer views your store and places a product in the shopping cart, but then leaves your site without making the purchase. Stats show that 7 out of 10 customers will leave a store shipping cart without making a purchase. Recapturing these customers could equate to big revenue. And a great way to recapture these customers is to use a personalized email highlighting the products that are still waiting in the shopping cart for them. You can even help give them a nudge by offering a coupon code for free shipping or a percentage off the sale.

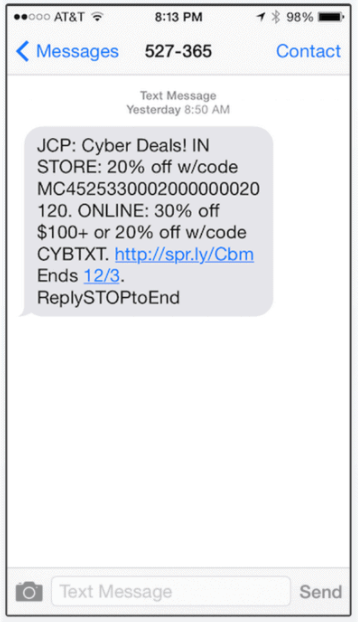

#2 Create coupons and discount codes: Speaking of coupon codes, this is a great method to help provide an immediate incentive to the buyer to make a purchase. Ideas include free shipping, 10% or 20% off the retail price, Buy One Get One and flash sales (short sales, typically for a few hours). Buyers can easily input the coupon code during check out and have the discount applied to their order in the cart. Nearly all shopping cart platforms allow you to easily make coupon codes. Don’t forget – along with posting coupon codes on the site, advertising and in email, you can also send them out via SMS text messages.

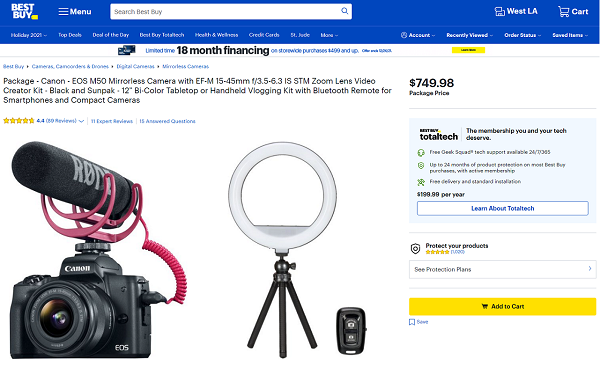

#3 Bundle Best Selling Products with High Margin Products: Bundling products is a great way to increase average order value. The idea is to package a few different products together as a “bundle” and then sell the bundle package at a lower price than if you bought them all separately. For reference, the combo at your local fast food restaurant is a great example of how bundling increases the average order value. Typically, you want to make sure the bundle package all has complimentary products (i.e. cell phone case to go with the cell phone) and includes a high selling product (to catch the buyer’s attention) along with a high margin product (to help you make profit).

#4 Run after-Christmas sales to increase profits: Don’t forget, the holiday sales don’t need to stop just because December 25th has come and gone. Retailers often have extra inventory from products that were not as popular as you anticipated. Plus, some buyers could have received cash or gift cards for Christmas. A good after-Christmas sale gives them a opportunity to use those gift cards!

Good luck and happy sales this holiday season!