New Harmonized Code Requirement Coming March 1

Beginning March 1, 2023, all shipments to and passing through most countries in the EU will need Harmonized System tariff codes, or HS codes, included on customs forms. More detailed descriptions will be required, meaning general descriptions like “clothing” or “electronics” won’t be accepted. According to the USPS, reasons for the upcoming change are important because they “improve speed and efficiency of cross-border ecommerce” and “meet safety and security requirements, preventing delays, fines, and penalties for noncompliance.” The full list of countries impacted by this change can be found on the USPS website.

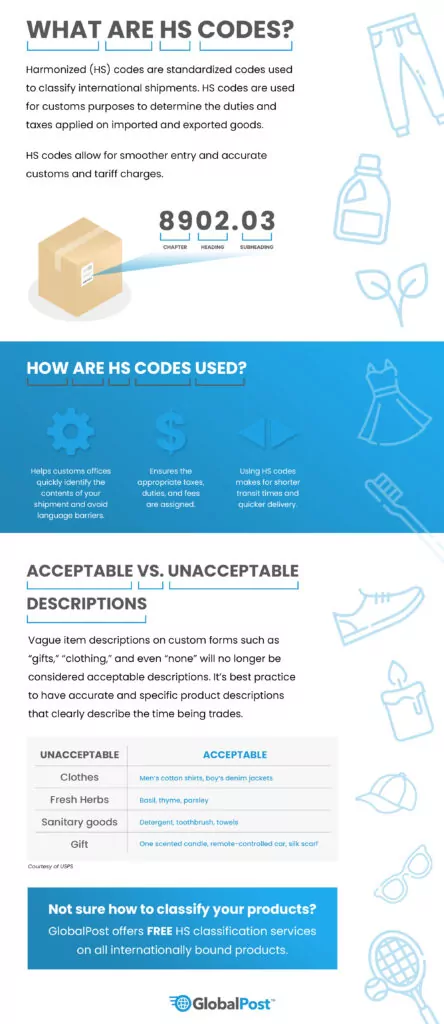

What are HS codes?

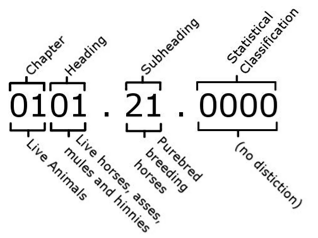

HS codes are numerical values given to all goods shipped to countries outside the United States. These codes were created and assigned by the World Customs Organization (WCO); a full list of HS codes can be found on the WCO website. Let’s go through a set of HS codes as an example.

Say you’re shipping coffee to a customer, and the HS code is 090111. Here’s what the numbers within your HS code represent:

- 09 – The chapter, or first two digits, is used to identify your product’s category

- 01 – The heading, or second two digits, is used to define your product’s attributes

- 11 – The subheading, or last two digits, combines the chapter and heading of your product

In this case, the chapter would be coffee, the heading might be decaffeinated and roasted, and the subheading would classify your product as coffee, decaffeinated and roasted.

Acceptable vs. Unacceptable Descriptions

Vague item descriptions on custom forms such as “gifts,” “clothing,” and even “none” will no longer be considered acceptable descriptions. It’s best practice to have accurate and specific product descriptions that clearly describe the items being traded.

| Unacceptable | Acceptable |

| Clothes | Men’s cotton shirts, girls’ leather vets, boys’ denim jackets |

| Fresh Herbs | Basil, thyme, parsley |

| Sanitary goods | Detergent, toothbrush, towels |

| Gift | One scented candle, remote-controlled car, silk scarf |

Why do HS codes matter?

HS codes help customs offices and departments identify the contents of your package so the proper taxes and duties are applied. Adhering to the new guidelines can prevent your shipments from being held up at customs and/or returned to your business. Also, HS codes help bypass language barriers because items are classified uniformly and easily translated.

GlobalPost HS Code resources

If you aren’t sure how to classify your product, our partner carrier, GlobalPost, will provide their customers with two free classification services: the On Demand HS Classification Tool and the free HS Code Fulfillment Service.

The On Demand HS Classification Tool is a searchable database designed to shorten the amount of time spent finding a product’s HS code. This tool is perfect if your business ships a small number of international orders, as you can search for up to five free classifications daily. There are also no additional requirements to use this tool.

The free HS Code Fulfillment Service takes the hassle out of finding the HS code. If your business is using GlobalPost for international shipping, GlobalPost will assign the HS code once your shipment reaches the GlobalPost warehouse as long as you have a description of your products. The same goes for customs forms. Shipments sent using GlobalPost don’t need printed customs forms, as GlobalPost will assign forms once a shipment arrives at their facility.

The inclusion of HS codes being mandated for shipments to the EU may seem like additional work. However, HS codes can shorten the amount of time your shipment sits in customs. It also decreases the chance of returned shipments or the incorrect amount of taxes and duties being applied.

If your business ships a higher volume of international shipments, consider using GlobalPost as your carrier of choice. Using GlobalPost eliminates searching for HS codes on your own, as GlobalPost’s Free HS Code Fulfillment Service will apply HS codes to your shipments for you. For more information on the new mandate for HS codes, we recommend reaching out to trade experts and service providers or visiting the World Customs Organization (WCO) website.

Note: This blog will be updated as we receive news regarding the new EU HS code requirements, so check back for new/additional information.