Why Use Certified Mail To Mail In Tax Forms?

Tax season is here and it’s time to get organized! If you are mailing in your tax returns this year, consider using Certified Mail with Return Receipt. With this service, you get a receipt showing when your mail was delivered or when delivery was attempted and also who signed for your return, making it perfect to use at tax time. Remember, if your tax return is postmarked by April 15th, the IRS considers it filed on time.

Tax season is here and it’s time to get organized! If you are mailing in your tax returns this year, consider using Certified Mail with Return Receipt. With this service, you get a receipt showing when your mail was delivered or when delivery was attempted and also who signed for your return, making it perfect to use at tax time. Remember, if your tax return is postmarked by April 15th, the IRS considers it filed on time.

Tax Time Tips for USPS Mailers

– Make sure your return is signed, otherwise the IRS will return it and penalize you for filing late tax returns!

– Make sure to deposit your returns in a collection box whose pickup time has not passed.

– If your return feels heavier than one ounce, weigh it and apply proper postage. The IRS will not accept a return with postage due!

How To Print Certified Mail With Stamps.com

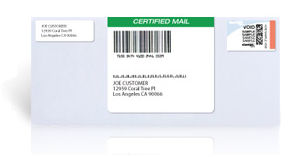

Stamps.com makes it really easy to print postage for Certified Mail, the ideal choice for mailing in tax returns. Here is how it works:

– Type in the destination address or have Stamps.com import it from any address book.

– Stamps.com prints all the necessary information on its built-in Certified Mail forms.

– Your mail carrier picks it up.

– Stamps.com stores all the information including Certified Mail number and certified delivery date in an easily accessible and searchable database.

If you are a Stamps.com Premier member, you can use our automated Certified Mail forms. With this feature, you can print postage, address information and all Certified Mail requirements (including a mailing receipt or Return Receipt) in one simple step.

If you are not a Premier member, you will need to fill out and attach USPS form 3800.