5 Tips For Handling Holiday Returns

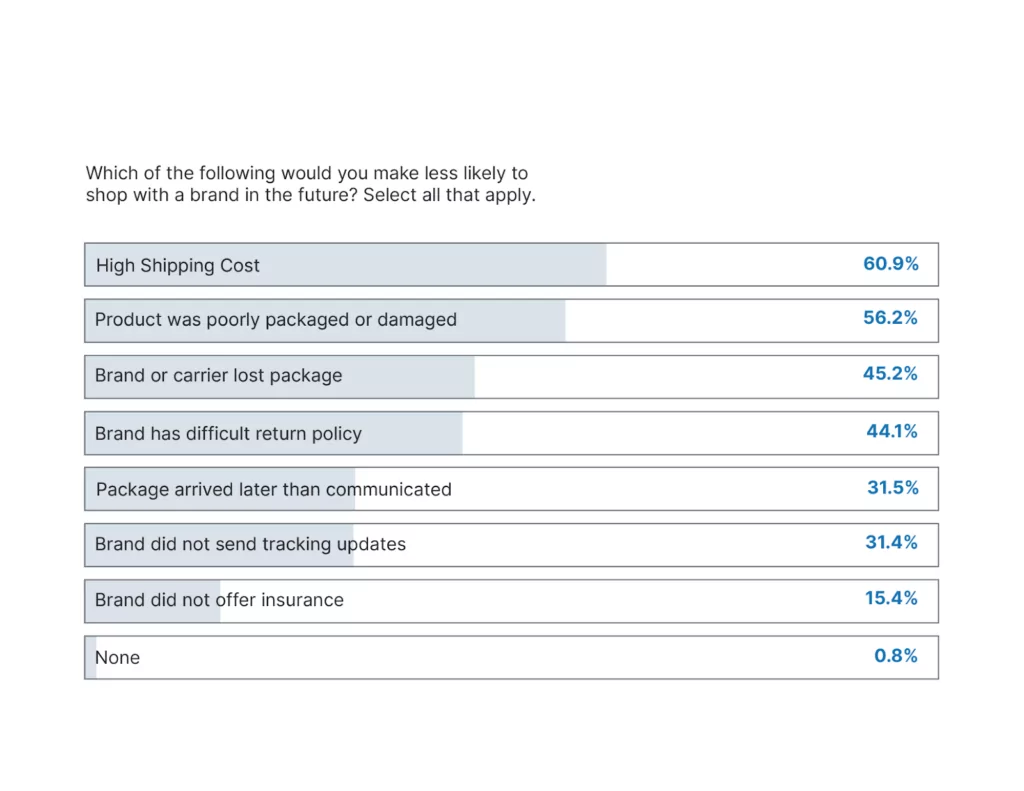

Regardless of the products you sell, returns will always be part of your business. Sometimes, clothing doesn’t fit correctly, a customer accidentally bought the same gift as someone else, or the recipient would prefer a different product. While the reasons may vary, your return policy should be consistent because customers are taking note.

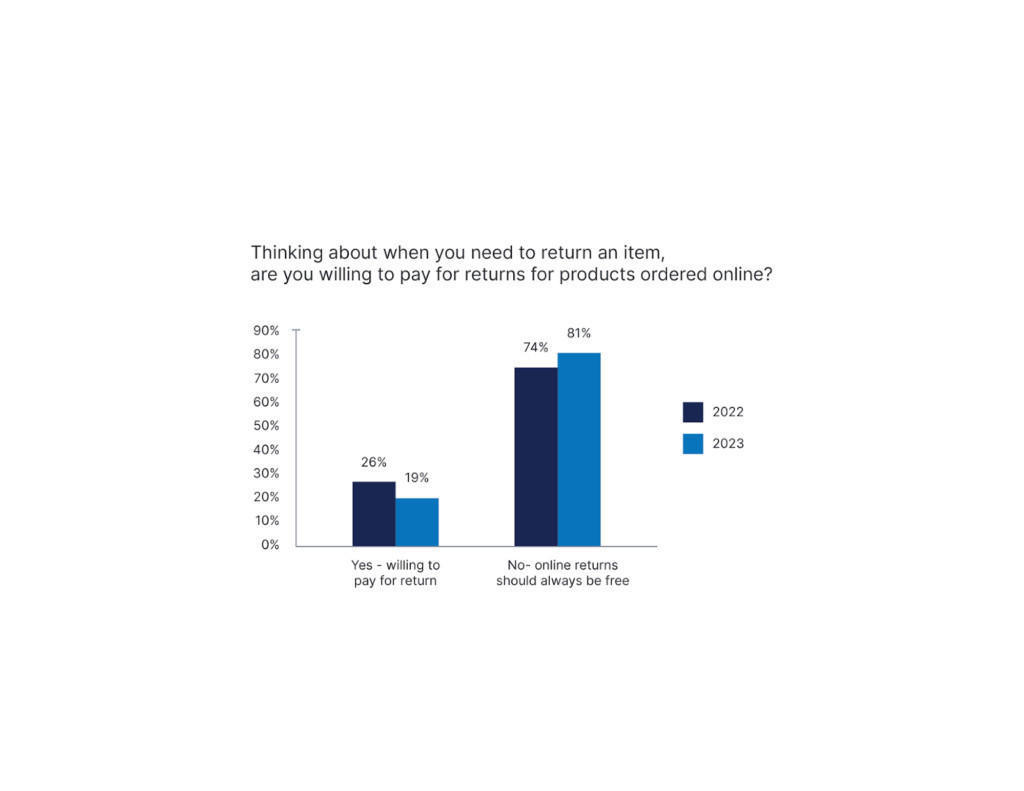

Our recent study with Retail Economics found that 24% of customers stated inconvenient returns were their biggest concern during the holiday season globally. With almost 1 in 4 customers letting your return policy influence their purchasing decisions, your business can’t afford to ignore customer expectations. We’ve created 5 tips to help businesses of all sizes craft a successful return policy to boost holiday sales and customer satisfaction.

1. Keep your return policy clear

Read through your return policy from a customer’s perspective. Are any steps unclear? Would you be able to successfully return a product to your business? If any part of your return policy needs a couple of rereads to understand, rewrite it. Customers should be able to follow your return policy without hesitation; if you can’t follow your return policy, it’s likely your customers can’t either. It also may be worth adding an FAQ section and/or bullet points within your text, so it’s easier for customers to scan.

On the other hand, too much text can prove to be confusing or difficult to read. Consider using graphics or illustrations to accompany your directions. For example, if you’re going to send customers a return label with their initial purchase, include a picture of a label so they know what to look for. You can even include illustrations or stock images of “customers” completing the return process to make your policy stand out from the competition.

2. Ask customers for feedback

Customer feedback is crucial for a business, especially during the holiday season. Asking customers the reason for their return can provide valuable insight for your business. For example, if customers are responding that a shirt doesn’t fit correctly, it may be time to adjust the sizing, description, and photo on your website.

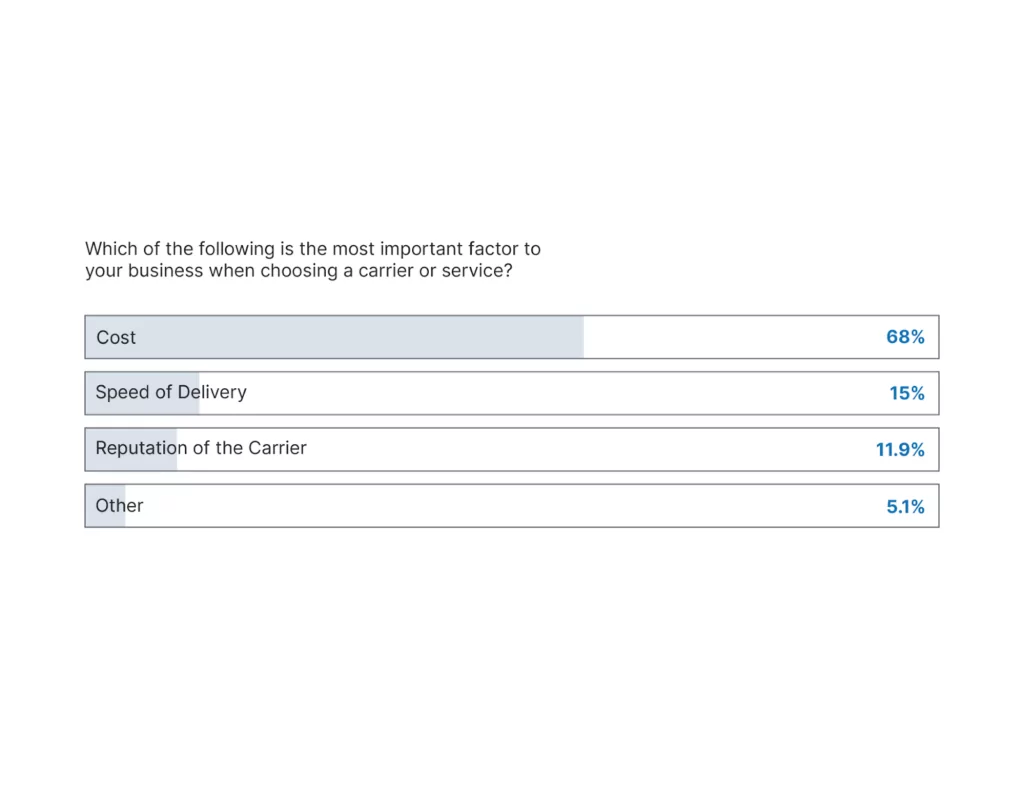

Additionally, if you begin to see feedback around late delivery, you may need to offer different carrier services to better suit your customers’ needs. Our study found that 40% of customers are most concerned about late delivery or packages arriving when no one is home globally, so it’s worth keeping in mind.

3. Consider offering exchanges

Say a customer loves the skirt they purchased from your store, but they need a different size or would like a different style. Instead of only offering returns, why not offer exchanges? Not only do exchanges help your business recoup some of the marketing and fulfillment costs spent on promoting and packaging products, but it shows your customers you’re willing to go the extra mile. This leads to increased customer satisfaction, which leads to the increased possibility of repeat business.

4. Reward quick returns

Between holiday travel and inclement weather, circumstances outside of your customers’ control can lead to late returns. We recommend extending your return window during the holidays for this very reason. However, you can still reward customers who return products within a shorter timeframe. The longer a customer waits to return their product, the higher the chance a product will have to be discounted and/or can’t be resold. Rewarding customers who can return orders faster will encourage them to do so in the future.

5. Provide customers with convenient drop-off options

Life is full of errands, and the holiday season only adds more. Customers may also be visiting friends and family, so they aren’t sure where the closest carrier drop-off locations are. Providing your customers with resources to find carrier drop-off locations helps them to drop off returns more efficiently. This means orders can be returned faster, as customers aren’t having to search for drop-off locations themselves. Most carriers include locator links on their websites that are easy to include on your website as well.

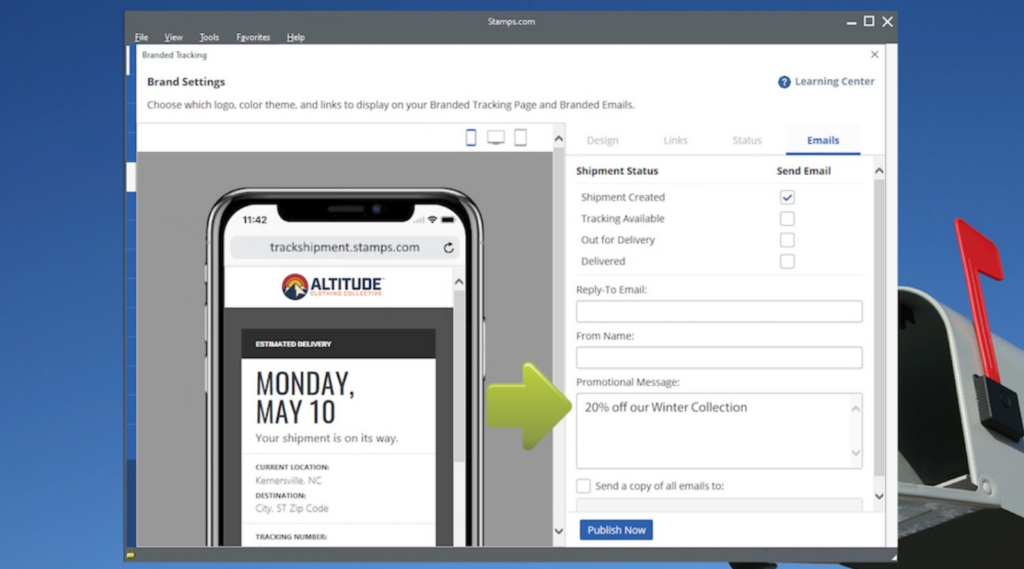

Ship and mail from anywhere this holiday season with the Stamps.com Mobile App.